Optimize your finance department with AI: a complete guide

Discover how artificial intelligence can transform your finance department, increasing efficiency and accuracy in financial management.

Welcome to the future of finance! In a world where technology is advancing at a rapid pace, artificial intelligence is emerging as the key to radically transforming every aspect of your business. This article is not just a guide; it is your passport to a revolution that promises to automate repetitive tasks, provide precise financial analysis, and free your team to unleash their true strategic potential.

Each week, in our series of articles, we show you how to implement AI in every department of your company, providing you with the necessary tools not only to stay up-to-date but to lead boldly in your industry. Discover how AI can turn your Finance Department into the innovative engine that drives the growth and success of your organization!

Table of contents

Why apply Artificial Intelligence to the Finance Department?

Applying Artificial Intelligence to the finance department not only transforms financial management but also boosts the efficiency, accuracy, and security of your operations. AI automates repetitive tasks, optimizes cash flows, detects fraud in real-time, and offers predictive analytics for smarter strategic decisions. With AI, your company not only adapts to the future but leads with innovation and competitive advantage. Are you ready to take the leap?

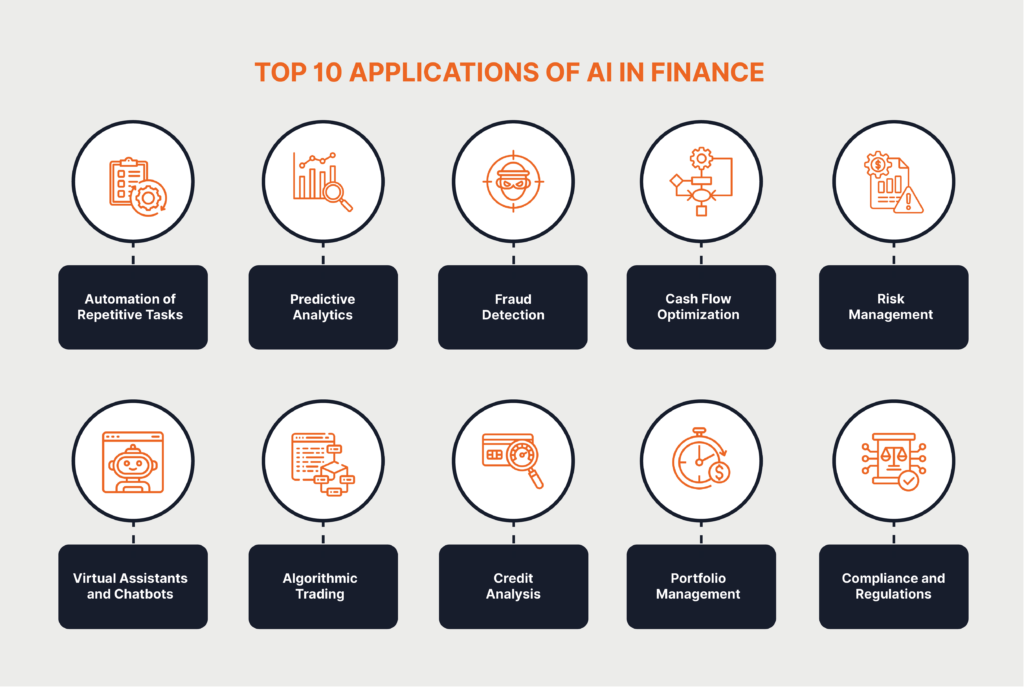

The top 10 applications of AI in Finance

The adoption of artificial intelligence (AI) in the financial sector has revolutionized how companies manage their operations, make decisions, and stay competitive in a dynamic market. Below, we explore the top ten AI applications in finance that are transforming this field:

1- Automation of repetitive tasks

AI enables the automation of routine and repetitive tasks such as bank reconciliation, data entry, and financial report generation. This significantly reduces the risk of human errors and frees up time for employees to focus on more strategic and value-added activities.

2- Predictive analytics

By analyzing large volumes of historical and real-time data, AI can forecast future trends and behaviors. This predictive capability is crucial for financial planning, risk management, and identifying investment opportunities.

3- Fraud detection

AI algorithms are highly effective at detecting patterns and anomalies that may indicate financial fraud. By analyzing transactions in real-time, AI enhances the ability to detect and prevent fraud, protecting both the company and its customers.

4- Cash flow optimization

AI helps manage and optimize cash flows by forecasting revenues and expenses, ensuring the company maintains the liquidity needed to operate efficiently. This is essential for financial planning and sustainable business growth.

5- Risk management

AI improves risk management by analyzing complex data and predicting potential financial threats. This enables companies to take proactive measures to mitigate risks and protect their assets.

6- Virtual assistants and chatbots

AI-powered chatbots and virtual assistants can handle customer financial inquiries quickly and efficiently, providing accurate responses and enhancing the customer experience. This allows employees to be more effective in their work, better managing their time and dedicating more resources to complex tasks.

7- Algorithmic trading

AI enables algorithmic trading, where financial transactions are executed automatically based on algorithms that analyze market data and patterns. This increases the speed and accuracy of transactions, improving financial returns.

8- Credit analysis

AI facilitates the assessment of creditworthiness of loan applicants by analyzing financial and non-financial data. This allows for faster and more accurate credit decisions, reducing the risk of defaults.

9- Portfolio management

AI optimizes investment portfolios according to the client’s objectives and risk profile. Algorithms analyze market data and trends to adjust investments in real-time, maximizing returns.

10- Compliance and regulations

AI helps companies comply with financial regulations by constantly monitoring and analyzing data. This ensures that financial operations are transparent and meet legal requirements, avoiding penalties and fines.

Tips for integrating AI into the Finance Department

Integrating AI into the finance department requires a strategic approach and careful planning. Here are some tips to ensure a successful implementation:

- Define your objectives and choose the right solutions: Before implementing any AI tools, clearly define your financial objectives. Do you want to optimize accounting, improve risk management, better financial planning, or automate treasury operations? If you are unsure where to start or which tools to choose, at Nucleoo we can help with our AI Maturity Assessment, a personalized strategic session to analyze your company’s AI maturity level and propose customized solutions.

- Train your team and foster a culture of innovation: Implementing AI requires a shift in work methods and mindset. Ensure your team is trained to make the most of the new tools and technologies. We offer our Awareness Pack, designed to teach you everything you need to know about Artificial Intelligence and how to apply it in finance. Additionally, encourage your team to adopt an open and experimental mindset, fostering a culture of innovation to facilitate acceptance and effective use of new technologies.

- Monitor, adjust, and set clear metrics: AI can provide valuable insights, but it is important to continuously monitor and adjust your strategies based on these insights to ensure long-term success. Define specific KPIs to measure the success of AI implementation in your finance department, regularly evaluate the impact, and adjust your strategies as needed.

- Ensure privacy and conduct pilot tests: Managing financial data is critical. Ensure that any AI solution complies with privacy and data protection regulations, such as GDPR. Before full deployment, conduct pilot tests to assess the effectiveness of AI tools in a controlled environment. This allows you to identify and resolve potential issues before a large-scale implementation.

- Collaborate with experts: Working with AI experts, like those at Nucleoo, can facilitate implementation and maximize benefits. Our team is here to help you every step of the way.

Real examples of AI in Finance

To illustrate how AI can transform the finance department, let’s look at some practical examples:

Robotic Process Automation (RPA)

RPA uses software to automate repetitive tasks such as data entry, bank reconciliation, and report generation. This not only saves time but also improves the accuracy of information, thereby preventing potential errors.

Machine Learning for Predictive Analytics

Machine learning technologies can analyze large volumes of data to identify patterns and trends. This helps forecast market movements, optimize investments, and manage financial risks.

Chatbots for Customer Service

AI-powered chatbots can handle customer inquiries on financial topics, providing quick and accurate responses. This improves the customer experience and frees up time for employees.

Introduce AI in your Finance Department today

At Nucleoo, we combine our expertise in technology and strategy to help you integrate AI into your finance department. From identifying key areas to selecting the right tools and training your team, we support you every step of the way.

Visit our dedicated AI page to discover how our solutions can transform your financial management. Contact us today and let our experts help you fully leverage the advantages of AI. Are you ready to take the challenge?